(Updated 2nd August) This is the second part of my Angel Investing Toolkit, following on from Part 1: Education. This toolkit is designed for investors with previous investment experience in public companies and/or a couple of existing angel investments looking to learn more. Hobby investors (like me) will likely get the most value out of it, but I’m hoping some professional Angels will also use it. Please add any suggestions or questions in the comments or add me on twitter to suggest ideas for Part 3 - Assessing Startups. If you’re interested in hearing more from me on Angel Investing or operating startups - subscribe.

What Is Deal Flow?

You have ravenously consumed all the literature there is on Angel Investing, you’ve listened to the podcasts, followed the investing Gods on twitter and your other half tells you you sound like Yoda in your sleep; spouting Naval pseudo-investing-philosophy. Now what? You’re ready to apply your knowledge to investing in startups, but you need Deal Flow.

A common reason cited for people not to become Angel investors, is that unlike public markets, where seemingly everyone has access to invest in the same companies, in private markets access to the best companies is not open to everyone. To put a twist on an infamous phrase from the Wolf of Wall Street:

Because by the time you read about it in Techcrunch. It’s. Already. Too. Late.

This may seem like a relatively simple concept, however it is worth explaining briefly that not all Deal Flow is equal, and the quality of any companies that you invest in at the bottom of your deal funnel is entirely dependent on the quality of companies that come in to the top of your deal funnel. It is therefore worth investing a significant amount of time in creating high-quality Deal Flow.

I have a friend from University who is now a professional athlete and co-investor with me in several companies. He’s kindly helped review the drafts for my Angel Investing Toolkit and asked me flat-out “but what do you mean ‘Deal Flow’ - surely all startups just go out to all investors and it’s first come, first served?”. In a world where money is the only value added (public markets), that may be true, but in the world of startups Founders are looking for investors who can add value. There is therefore a hierarchy of investors that the best startups will approach for capital. This hierarchy is determined by how much value the investors could add through helping them attract talent, attract customers, helping them close their next funding round or simply providing the best advice at pivotal points on their journey. If you are not at the top of this hierarchy (or tap into their Deal Flow), you will not have access to the best startups. This will have a dramatic impact on your potential returns. The hierarchy looks something like this:

Experienced / Famed Angel Investors

Exited Former Founders

Current Founders

Top tier VC funds

Less Experienced Angels

Celebrity Investors

The rest of the VC funds

Crowdfunding Websites

Firstly, I’m a big fan of Crowdfunding websites in their role democratising access to startup investing. You will find some great companies on crowdfunding websites, but typically they use it as an add-on for later stage rounds, and therefore if you want to get into the best Seed rounds you typically have to go higher up the hierarchy. This post isn’t for those looking to invest via crowdfunding but three of the best sites out there are: Crowdcube, Seedrs (both UK) and Republic (US).

It is unlikely that you are reading this post as someone at the top of the hierarchy, but I’m going to share the tools and hacks to get you the same Deal Flow as the most experienced in the business.

Quality of Deal Flow

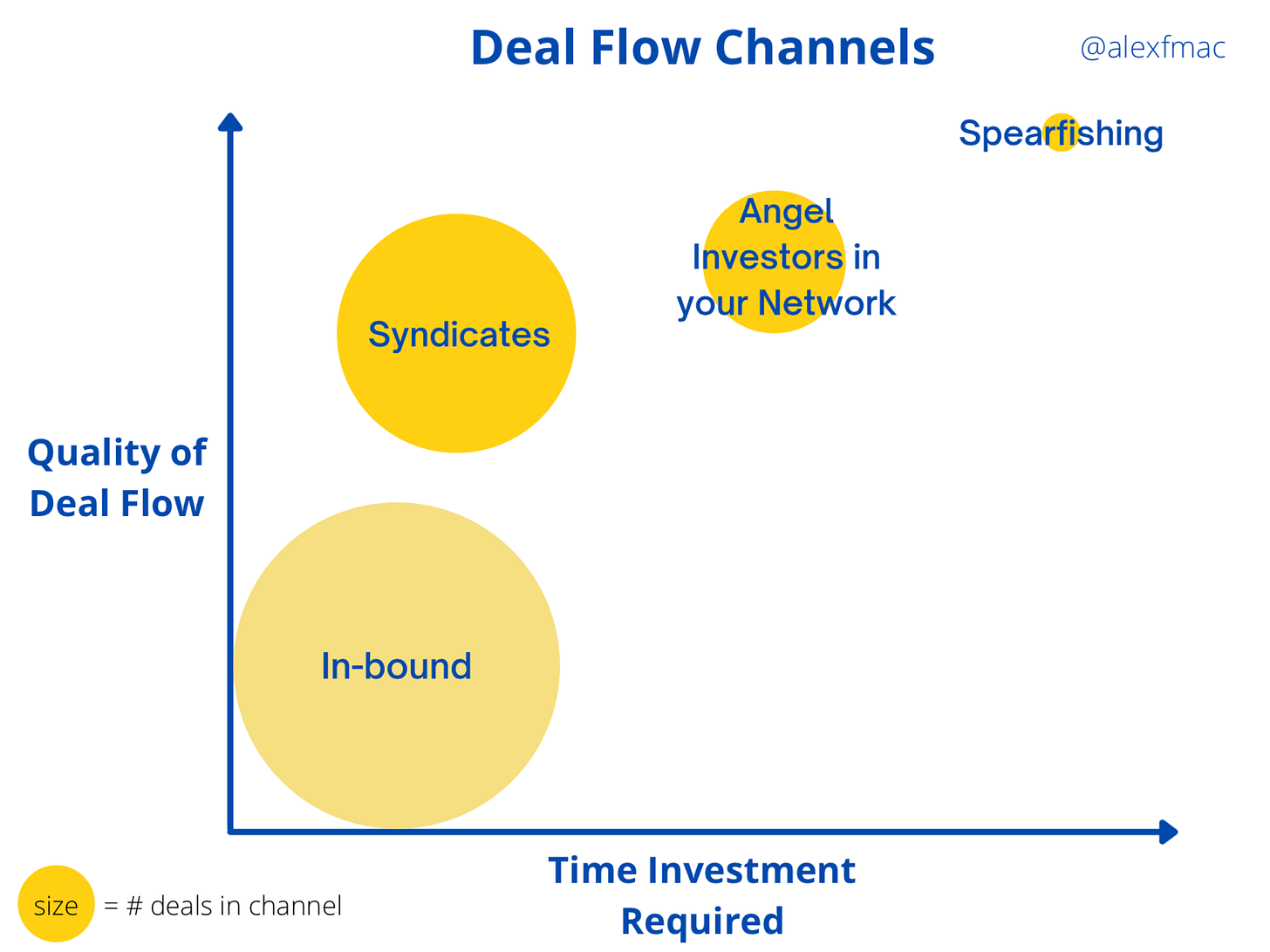

I categorise my Deal Flow into four core channels: Spearfishing, Angel Investors in my Network, Syndicates and Inbound. The chart below categorises my Deal Flow based on the Quality, Volume and Time Investment required across those channels for the past 6 years. I’m going to go through my tools for each of the four channels in this part of the Toolkit.

1. Syndicates 💰

If you are just getting started in Angel Investing, joining the best syndicates is the quickest way to get high-quality Deal Flow.

You benefit from their Deal Flow, quality filter and all their due diligence (saving you dozens of hours of time) in exchange for giving them a small share of your profits should the investment go well. You also learn from their deal memos how they think about startups and their model for analysing and making investment decisions. Finally you can typically invest with a much smaller cheque size through a syndicate than you can by investing directly in businesses, allowing you to diversify.

Here are some of the most interesting syndicates:

The Syndicate - Started by the most ambitious Angel Investor in the world, Jason Calacanis. This is probably the best Pre-Seed, Seed and Series A Deal Flow on the West Coast of the US.

Alchemy - New, UK focussed syndicate with experienced angel investors, founders, operators and VCs as members. While there is no cost to join, you do have to apply, message me directly if you would like access. Disclosure: I’m one of the Founding Members.

Alma Angels -All female-founded teams receive <1% of VC funding in the UK. Alma is focussed on creating a level-playing field for female entrepreneurs in the UK and Europe. (by Deepali Nangia, Ella Goldner, David Fogel and Kristin Cardwell.)

Ventures Together - Strictly limited to Founders, Operators and active investors, membership by invitation only. The most active syndicate of any that I am a member of. (by Rob O’Donovan and Tom Savage)

Future Africa - Africa is one of the biggest projected growth markets for technology in the next decade. Future Africa invests in some of the best mission driven startups. There is a membership fee in order to access their syndicate, but certainly the highest quality African syndicate I have come across. (by Iyinoluwa Aboyeji)

Angel Academe - Angel investing syndicate with a predominantly female membership, focussed on investing in startups with at least 1 female founder. (by Sarah Turner and Simon Hopkins)

Operator Exchange - High quality group of former founders and operators focussed on investing in the best European tech companies. More about them here.

Assure Syndicates - Assure powers some of the most prominent syndicates outside of Angel List (eg The Syndicate above). They also have a product for matchmaking angels with great deals. Some of the best Deal Flow in the US and I just received their latest Deal Flow email - which is better than any other Syndicate (video FTW). (by Landon Ainge)

Horseplay Ventures - More of an investment club than a Syndicate, but fantastic Deal Flow and well-networked community. (by Nick Telson and Andrew Webster)

HERmesa - HERmesa not only provide a very active Angel investing syndicate but also an educational framework delivered by experienced Angels. (by Maria Shapiro)

AngelList- There is a syndicates feature on AngelList with several hundred syndicates who have closed several thousand investments in the past year. This a great place to find syndicates that fit your investment criteria.

2. Spearfishing 🔱

Spearfishing is the most-time intensive of all channels for creating Deal Flow, but it will also yield the highest quality results and the startups with the best fit for your investment strategy. You will spend many hours swimming through barren waters before you manage to spear the 300 lb tuna, so this channel should only be used if you have significant time to invest. The challenge is that there is not very much information online about the very earliest stage companies, and where there is, the information is often sparse and not filterable. There are however a few tools I use to great effect to Spearfish:

ProductHunt - ProductHunt is a platform where developers and Founders launch their products. Every day there is a new list of recent product launches which the ProductHunt community upvote. You can browse by topics and collections and therefore focus on areas which fit your investment thesis. If you find products which are both popular and fit your investment thesis, reach out directly to the Founders to see if they are raising / how you can help. I have found ProductHunt is best for consumer and B2B SaaS products (for SMBs), but light on enterprise tech and deep tech.

AngelList - Is one of the first places startups (particularly in the US) create a profile to start hiring and raising money. It is a good database which is filterable based on stage and sector. More on the syndicates part of Angel List below.

Crunchbase - Affiliated with Techcrunch. While this is one of the higher quality databases out there, it tends to be most useful from Series A onwards. At Seed stage, per the above, by the time it’s in this database it’s already too late.

Thingtesting - Similar to ProductHunt, focussed on new online brands, but mostly consumer facing products. Built by former VC Jenny Gyllander.

Angel Investment Network - UK focussed network connecting founders raising money and angel investors. While this is closer to a crowdfunding platform, I do still find some quality companies raising money on here. Advantages are you can filter very effectively by ticket size and type of company you look to invest in.

Beauhurst - Likely the richest and best researched dataset on the UK’s fastest growing companies. You can get a free trial, but the full product requires a subscription. Most useful for those investing post Seed stage.

4 New Spearfishing Tools (added 2 August)

Seedscout - by Mat Sherman - a structured pre-seed and seed stage database with daily email updates. The data is structured well so you can easily filter to target companies which fit your criteria.

Koble - by Damian Christian and Guy Conway - a data driven algorithm for helping investors select the best startups from their Deal Flow. An ambitious product.

Connectd - by Roei Samuel - I’m in two minds about databases that charge startups access to investors, but there does seem to be some good value-add here for Angel Investors.

Flowlie by Vlad Cazacu - still in Beta but from the sign-up process seems to be focussed on high quality matching.

3. Building a Network of Angels 🌐

Building a network of Angels will secure you high-quality deal flow. If you become close friends and add value, you’ll find you benefit from their Deal Flow in two ways. Firstly these will be deals that have already passed their quality filter, and therefore not a complete waste of your time. Second if they know the criteria for your investing, you will find the deals they send are relevant to you. 2 of the 6 investments I have made in the last year were sent to me by 1 Angel (and he only sent me ~10 deals - making him the highest conversion channel for me ). Typically the best deals are not found in the public forums below, but the connections you make in the forums will share them with you directly… or add you to the WhatAapp groups where all the action happens.

Some of the most productive Angel communities I am a part of (and others I know are members of) are off the back of some of the Angel and VC investing courses I mentioned in Part 1 of the Angel Investing Toolkit, in particular Angel University and Kauffman Fellowship.

Communities 🧑🤝🧑

This Week in Startups (TWIST) - Slack community with more than 39k members including ~700 or so Angel investors. Lots of high quality content here as well.

GenZ VCs - A global community of 9k+ founders and investors. There is a focus on Generation Z companies and trends, but don’t worry if you’re a millennial (or older) like me - you can still join. (by Meagan Loyst)

Acquired.fm - Built on the back of the successful startup podcast, this community has more than 8k members around the world. (top tip: join the Startups To Watch channel).

Odin - A Europe focussed startup and investor community with 400+ members. High quality deal flow and discussion. Message me if you would like an invite. (by Patrick Ryan and Mary Lin)

Cambridge Capital Group - A network of UK based Angel investors. CCG also has a syndicate, great for building Deal Flow directly or connecting with other angels.

TechLondon - Community focussed on London tech. Not investor focussed, but there are many Angels in the 9k+ members.

UK Business Angels Association - Membership based community of Angel Investors in the UK. Great for making your first connections in the space.

Events 🎉

Y Combinator Demo Day - The best of the best. You benefit from the quality filter of Y Combinator selection process. Be prepared to pay for the best Deal Flow in the world (in terms of valuations).

LAUNCH Demo Days - Another product of the most prolific man in early-stage investment, Jason. High quality startups and therefore high quality Angels.

Angels Den - Pitching events where you can connect with Founders and other Angels. Thematic with a good cadence of events organised. Plus they have an AI-powered matching engine… to help you find the best startups relevant for you.

Angel Capital Association Events - UK focussed. I have not personally attended these events, but some interesting round tables and networking events to meet other angels.

Paradigm Talks - London focussed community for investors and entrepreneurs (with in-person events!).

Future Founders UPitch - US Focussed fully virtual pitch event. Next event details announced in the fall.

4. Inbound 📬

Inbound is the highest volume Deal Flow channel I have, and also the lowest quality. However there are several ways to increase both volume and quality of Deal Flow through Inbound. The most important part of Inbound is replying to as many of the messages as you can (I need to get better at this). The more you reply to, the more your Inbound Deal Flow will grow.

In all the platforms below, the more information you give in your profile about your investment criteria, the higher quality your Deal Flow will be.

Make sure your existing social channels (Twitter, Facebook, LinkedIn, Instagram, Snap, TikTok…) have ‘Angel Investor’ in the bio. You would be surprised how many deals will come through these channels once you do this (particularly LinkedIn where Founders can filter by this title).

Ensure you have investor profiles on the following platforms: AngelList, Crunchbase, Signal and Angel Investment Network .

Add yourself to the following publicly available investor databases:

No Warm Intro Required - a database of investors willing to share public info for reach-out. Again the more information you give about investment criteria, the better the Deal Flow.

Gritt - A free Angel database for founders. Reach out to Adrien Moreau-Camard to be added.

Active Angels List by Trace Cohen - message him to be added.

Takeaways from this post:

Focus initially on high quality channels with minimal time investment -> Syndicates.

Build relationships with Angels and Founders through online networks and in-person events. Stronger relationships are naturally made in person.

Set your public presence up correctly to generate low time-investment Deal Flow through inbound.

Thank you for reading Let me know if there are any other resources I should add.

If you want to hear more from me about Angel Investing or Operating, sign-up below and I appreciate you sharing.

Part 3 of my Toolkit is about assessing startups in your Deal Flow in order to make the best investment decisions. If you have any suggestions for startup analytical models, please also reach out.