In a break from my Angel Investing Toolkit, I’m sharing the memo I wrote for Alchemy syndicate’s first investment - Sellar. Alchemy led the Seed round, with existing investors and experienced entrepreneurs joining the round. I am sharing the memo so you can see a little about how I assess startups in my investment funnel (ahead of part 3 of the Angel Investing toolkit) and particularly a few nuances on marketplace businesses, which I will eventually write a dedicated post on.

First a bit of background. Nick Telson of Horseplay Ventures introduced me to Julian Bourne, Co-Founder and CEO of Sellar at the start of 2021. I was intrigued that a marketplace launched in February 2020 (really) which predominantly serves trade buyers in hospitality had seemingly grown well despite the headwinds of Covid. Nick and I have co-invested in several businesses together and he’s a consistent source of high quality Deal Flow for me. I therefore pay attention to his introductions.

I first spoke to Julian on a cold, rainy weekend in the midst of yet another lockdown. He is a great pitcher, his enthusiasm and passion for a business and space which many would consider to be ‘unsexy’ pushed the grey weather and draconian government measures from my mind and motivated me to dig deeper.

Vision and the ability to sell an idea are key traits I look for in Founders but without execution they’re worthless, just ideas with no results. Therefore once ticking the box of a great pitch (what they say) I tend to track progress over a few months to see if they have the execution to back it up (what they do) as well as digging into the market and historical performance.

Julian and his Co-Founders Matt and James continued to execute phenomenally over those few months, growing 21% MoM while remaining ramen profitable. This is astonishing for a marketplace business, which typically have inefficient early growth (they have to invest in sales and marketing to sign up both sides of the market), which made me turn my attention to their growth engine.

Sellar have the best organic growth engine I have seen in any marketplace business I’ve looked at in the last 6 years. More details on it in the memo, but the referral rates on both sides of the marketplace are high, 90% of the supply side acquired by word of mouth and referrals and the demand side has been 100% acquired through the supply. I have seen these kind of numbers in some very early stage companies, but typically the picture changes once they get beyond referrals from their immediate networks (friends and family), with Sellar it was already scaling to thousands of suppliers and buyers, and it was accelerating.

I quickly decided I was going to invest. Having invested with a number of friends in a WhatsApp group Investment Club for the past few years, we had seen a big impact on several businesses, to the point of effectively leading rounds, and thought a syndicate would be a better way of structuring the investments we were making to maximise impact on the companies we had high conviction on. With a few others, Alchemy was formed with the help of Odin’s syndicate platform.

Thank you to all the Alchemists who put their faith in Alchemy and Sellar and participated in the Syndicate. The response to Sellar and the Memo was phenomenal. To the extent that Julian and his existing shareholders agreed to increase the size of the round, with a second close in a few weeks time (apply through Alchemy or reach out to Julian if you want to know more).

The Memo

Summary

Sellar are creating the new trade order experience for the $1.7 trillion alcoholic drinks industry.

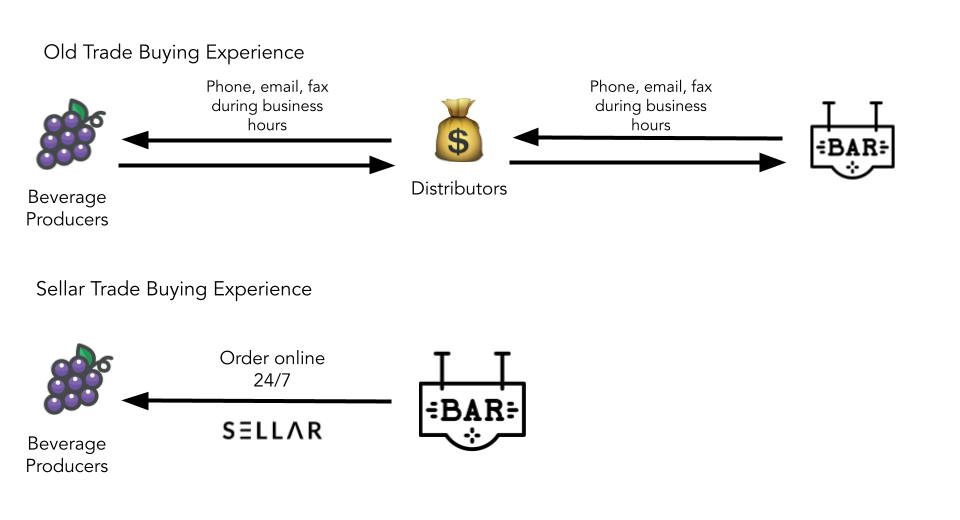

Sellar is a SaaS enabled B2B marketplace that connects beverage producers directly with trade customers, eliminating the middleman and disrupting the distributors.

Breweries, wineries and other beverage producers currently sell their products in an offline way (phone and email) which often requires synchronous communication, is time consuming and inconvenient for them and more importantly for their customers.

The company charges a monthly SaaS fee (ranging from £75 - £300 per month) and a transaction fee of 1-3% on orders placed through the platform.

The platform launched in February 2020 and despite the challenges of Covid has signed up XXXX beverage producers, YYYY trade buyers, £Xm GMV and has a current monthly revenue of £XXXX (May 2021) which is doubling every 5 months. The company has been ‘ramen profitable’ for the past 6 months.

The company is raising £500k at a pre-money valuation of £3m.

Why am I investing?

Thesis → all forms of buying and selling are moving online, accelerated by the need for convenience, trust, speed and safety. The digitisation of B2B markets and Trade in the UK is gathering pace and a theme I am already invested in (Snap-It).

Marketplace Dynamics → they have a growth engine which is already working very efficiently, with the supply side signing up the demand side. This is the dream in marketplace businesses, as it enables capital efficient growth.

Product Market Fit → Product is live and working well, with 83% of supplier acquisition from inbound (referred or direct web traffic) = clear demand from paying customers given lack of investment in sales and marketing to date.

Founding team → the founders are young, but compliment each other in terms of skill sets. They have proven to be very adaptable and shown resiliency despite Covid headwinds to get to where they are today. Julian is one of the best pitching founders I have come across and responds well when challenged with in-depth answers to Q&A.

Problem → Solution

The old trade ordering experience involves weekly mailouts, phone calls, static documents, emails and even fax machines (!). As a buyer you can normally only order during business hours and you have a different ordering experience with each supplier. As a beverage producer you track orders in multiple spreadsheets, leaving the door open to human error and with questionable security of customer payment data.

The Sellar experience has real-time product availability, 24/7 ordering, automated procurement administration, centralised platform to order from all suppliers and secure payment. Beverage producers save 40+ hours per month by managing orders from 1 dashboard with real time delivery and payment status, automated.

Market Size

The global alcoholic drinks industry is £1.2 trillion. There are three addressable markets for Sellar within this.

The UK alcoholic drinks market is forecast by Statista to be £51.5bn in 2021, of which 60% - £30.9bn is estimated to be B2B. If we narrow this down to just the ‘middleman’ distributors, this equates to a £12bn market.

The founders believe a close proxy for the type and size of business they are disrupting is XXXX, a UK focussed alcohol distributor who had a turnover in 2020 of £1b, a gross profit of £129m and an operating profit of £20m.

There are estimated to be more than 5k beverage producers in the UK (and more than double this in brands when you take into account white-label manufacturing), broken down as follows:

Total producers: 5,061

If we are to limit the addressable market to licensed premises (which I believe underestimates the market opportunity) then this would lead to an approximate (pre-Covid) addressable market of 116, 500 sites in the UK.

Secondly, Sellar have seen a new type of buyer sign-up to the platform: businesses and offices buying refreshments for their teams and staff parties. This is still small, but a good example of another end market the platform can address.

Thirdly direct to consumer is a significant market opportunity which represents the majority of the other half of the £1.2 trillion global industry.

Product

The product is fully formed and operational, processing orders. The platform is currently a web app, accessible on desktop, mobile and tablet devices. I have signed up and tested it from a buyer perspective including connecting with beverage suppliers, viewing their stock, ordering and paying, it was a seamless experience.

On the beverage producer side, the fully integrated dashboard for managing orders and customers is a key feature.

The future product roadmap includes:

Self-serve on-boarding (this is currently completed on the back end by the team and barrier to accelerating growth)

More features to enable business development / supplier discovery (moving up the value chain from procurement / sales software to becoming a source of orders for suppliers)

Integrations with third party systems

Logistics service

Growth Engine

Sellar have a bottom-up market approach, focussing initially on the long-tail of the UK. While the numbers so far are relatively small, if you dig deeper into the drivers of their growth engine, the power of their marketplace is staggering and will translate into very capital efficient growth as they scale.

In short:

Supply on-boards the Demand -> 100% of their buyers have been acquired by the suppliers. This is the dream for marketplace businesses, it enables you to focus your money and time on one side of the marketplace, rather than dividing it in two.

High referral rates from supply -> 70% of inbound supplier leads are generated by referrals from existing beverage producers on the platform.

High referral rates from buyers -> 30% of inbound supplier leads come from buyers who have referred supply

Future plans to use the Delivery Hero Ghost Profile model for users to create profiles and SKUs for suppliers to claim

This growth engine in the long-tail will attack what is estimated to be a £364m revenue opportunity for Sellar in the UK.

The second growth angle is large accounts with nationwide presence. This will require investment in a sales team and likely some product specialization for larger clients . This segment of the market is estimated to be a £636m revenue opportunity for Sellar.

The final growth phase involves leveraging their existing partners to penetrate new markets around the world. This will require additional currencies, languages and further product specialisation for tax, logistics in other markets. Estimated revenue opportunity of £12 billion.

Metrics, Forecasts & Exit

Summary of core metrics below for past 6 months:

Supply (beverage producers) -> Oct 20: 28 to Mar 21: XXXX (221% growth)

Demand (trade buyers) -> Oct 20: YYYY to Mar 21: YYYY (47% growth)

MRR -> Oct 20: £XXXX to Apr 21 £YYYY (120% growth)

Total GMV transacted £Xm

Updated metrics (July 21):

Monthly Revenue: May - £XXk (21% MoM Growth in 2021 up from Xk at start of year - the company is Ramen profitable still).

Supply (drinks producers / brands) : Today - XXXX Up from XXXX at the start of 2021

Trade buyers : Today - YYYY Up from YYYY at the start of 2021

GMV Total to date - £Xm Up from £Xm at the start of 2021

The future revenue streams in the model include:

Subscription revenue (live)

Transaction revenue (live)

Fulfilment / Logistics revenue (2023)

D2C revenue (2023)

Sellar Product & Inventory revenue (2023)

Buyer Pro Features (2023)

In my opinion the founders have slightly over-estimated the fulfilment / logistics revenue opportunity but significantly under-estimated the D2C revenue opportunity.

I think there is also a significant opportunity around financing between trade buyers and the supply, partnering with someone to help provide longer payment terms for the buyers and financing this for beverage producers.

Looking forward they are forecasting to hit £71m of revenue in 2025, with more than 9,000 beverage producers on-boarded. Based on current exit multiples for B2B SaaS companies, this would equate to an enterprise exit valuation of £710m-£1.06bn.

In the shorter term they would be looking at hitting a £Xm run rate of revenue within the next 18 months.

The Team

For me this is the most important aspect of investing at pre-seed / seed stage. While what Julian and his Co-Founders have pitched is very polished, the proof is always in what they achieve in terms of progress.

This team took what was an unsuccessful MVP (under a previous name - Waffle) and completely pivoted the product to get it to product market fit. Adaptability and resilience are two of the most important qualities for me in founding teams, and this team has it in spades.

Julian Bourne - CEO - Julian is a recent graduate who took the previous version of their product (waffle) through the Techstars accelerator process and raised money from Metro AG.

James Powell - CTO - James has built the fully functioning product you see today. Studied Computer Science at Loughborough and previously worked for Deep Secure.

Matt Pritchard - Product - Matt has a design and product background with previous roles at Unilever and Fintech app Mulalo.

Advisors:

Nick Telson - Founder DesignMyNight (exited 2019), Founder Horseplay Ventures invested in multiple startups.

Ben Stephenson - Founder & CEO at Impala (Series B travel marketplace business)

Risks

There is little in the way of current direct competition. The closest would be XXXX. They are closer to a more traditional distributor in their model, currently handling the logistics and therefore pricing is less competitive on the few brands that I have tested.

The biggest competitive risk in my view would be a large drinks conglomerate building their own platform, but outside of their existing client base they would struggle to gain traction given competitive tensions with other drinks conglomerates.

Given that initial product / technology risk has already been removed, the other largest risk is execution on the sales and marketing with a young and inexperienced team.

The other usual risks apply:

Most startups will fail

Only invest what you can afford to lose

Long-term impacts of Covid-19 remain uncertain

Thank you for reading, as usual I appreciate sharing and any feedback you have - get in touch here.