The VC Squeeze

The Disruption of Venture Capital & Interview with Jonathan Sun of Horizan VC

In 2005 Paul Graham wrote The Venture Capital Squeeze. I was just leaving school at the time, and had no idea who Paul was (sorry Paul).

In fact I had not read this particular work of Paul’s until 15 minutes ago, as I was about to hit publish on this post. I decided to google the title I had chosen for this, and Paul’s was the first result.

Here’s how it starts:

In the next few years, venture capital funds will find themselves squeezed from four directions. They're already stuck with a seller's market, because of the huge amounts they raised at the end of the Bubble and still haven't invested. This by itself is not the end of the world. In fact, it's just a more extreme version of the norm in the VC business: too much money chasing too few deals.

Back in 2005 Paul argued that open source, Moore’s law, the internet, and better development languages would make the creation and distribution of software a lot cheaper and therefore it would be harder for VCs to deploy their capital.

Today Venture Capital faces a similar ‘squeeze’, but the causes and the consequences are very different. The traditional Venture Capital model has likely never been under threat to the extent it is today. At the same time there has never been as much money flowing into traditional venture capital funds as there is today…

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.

Charles Dickens - A Tale of Two Cities

The traditional VC model is about to enter a Dickensian era. VCs who do not innovate will quickly find themselves hungry and left-out in the cold.

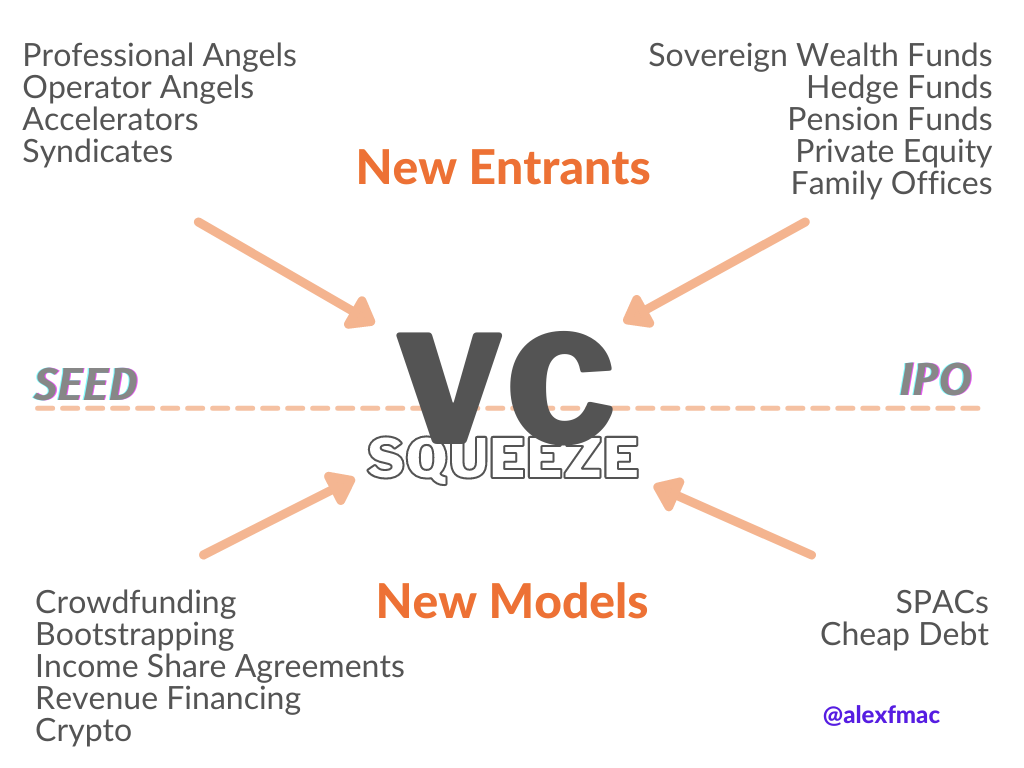

A perfect storm of new investors and new models for raising capital at both the early and late phase of the startup journey are squeezing traditional VCs into an increasingly crowded middle.

At the same time VC war chests are overflowing. Low interest rates, increasing inflation and the realisation of Marc Andreessen’s ‘Software is Eating the World’ prophecy have caused a flood of capital into riskier assets and therefore VC funds.

What will the consequences of the VC squeeze be?

In the short-term the flood of capital into VC and new competitors to VC will see continued inflation of startup valuations. The consensual hallucination will continue until there is a correction to valuations in the public markets. Once this correction occurs traditional VCs will be forced to innovate. The alternatives are either plowing money into companies who don’t need it and will not provide the returns they need, or returning the capital to LPs…

We’re already starting to see innovation in the traditional VC model and I predict existing firms will follow one of three core strategies:

Crypto: Venture firms raise funds entirely dedicated to Crypto, Andreessen Horowitz recently launched a $2.2 billion crypto fund.

Permanent capital: firms pivot to structure themselves as Hedge Funds or managers of ‘permanent capital’, as Sequoia recently announced.

Geography: Allocating capital to nascent venture markets where competition from new entrants and models does not yet exist. As exemplified by Harry Stebbings’ 20VC Fund investments into Pakistan.

New VC managers will explore different structures in order to tap into the bootstrapping movement and move earlier in the funding journey of companies.

One of this new breed of (alt)VCs is Jonathan Sun.

I first met Jonathan earlier this year through Gen Z VCs. If you go to startup meet-ups in London, you’ve probably met Jonathan, he’s at all of them! He embodies all the best traits of the startup ecosystem, he’s open, positive and pays it forward.

Jonathan is an example of how naivety and inexperience are weapons you can use to great effect when innovating to disrupt the status quo.

As a change-agents in the venture ecosystem, he identified an opportunity in the chaos, and launched an entirely new funding model for UK idea-stage entrepreneurs.

I want to shine a light on Jonathan and what he’s doing, so I invited him to tell you all about it…

Alex: Jonathan, tell us about your journey in venture so far.

Jonathan: My journey to becoming an Alt-VC has been very unconventional. While I was a student at the University of Washington, Seattle, I worked on an app for 3 ½ years, trying to match high school students to their best fit universities using metrics such as their personality, hobbies, and environmental preferences.

We attempted to get acquired but ultimately failed at doing so. In between I would sometimes visit London in the summers (it’s my hometown, after all) and would try to get to learn about the tech ecosystem down here a little. Ultimately, I made it my long term goal to come down to the UK and make money by contributing positively to the startup ecosystem here. So I moved down to London in September 2020 and initially made some pocket money helping startups validate business ideas with pretotyping and hosting events with a social co-working network called Othership.

In my spare time I would try to study investing and learn all about the world, because lots of founders would complain to me about the difficulties of fundraising at the pre-seed stage. I read Jason Calacanis’ book “Angel,” took Angel Investment School, scouted for Odin, and learned throughout all of my experiences that pure SAFE note investing didn’t fit the majority of entrepreneurs.

Alex: What led you to found Horizan VC? What problem are you trying to solve?

Jonathan: Basically, I wanted to find a way of structuring investing for the 80+% of founders that didn’t want to blitzscale. Pure SAFE note investing was only great for companies that wanted to 10-20x, and many founders just wanted to build a slow-growing profitable business. In addition, many founders don’t get angel/VC money because either they are “too early” or don’t fit the demographic background that investors are used to.

I studied a variety of Alt-VC platforms in the USA from TinySeed, Calm Fund (Earnest Capital), Village Capital, and Indie VC before partnering with Chisos Capital, who invented the Convertible Income Share Agreement (CISA). The Convertible Income Share Agreement merges a SAFE note with an Income Share Agreement, where if the founder is earning above a certain threshold, he/she pays 10% of his/her monthly income up until either a 1.5x repayment cap in 5 years or a 2x repayment cap in 10 years. I thought this idea was genius and was the instrument I felt that was needed to revolutionise friends and family fundraising in the UK/EU.

The team there were kind enough to send me all of their proprietary documents to use in the UK/EU, and subsequently with the help of some lawyers and Stepex, we created the CFEA (Convertible Future Earnings Agreement) which is basically the same as the CISA. Horizan VC was born.

Alex: How did you bring together the founding team?

Jonathan: I met my cofounder, George Quentin, at Angel Investment School, and when we met a couple times for coffee he got a chance to find out about what I was working on. He became really interested and asked if he could help, so gradually started off with some small tasks and gave him bigger and bigger ones until he became my cofounder.

The other three members of our Investment Committee (Toby Allen, Viraj Ratnalikar, and Ryan Thorpe) I met when I posted a job blurb in the Indie London community titled “Peer Selected Investment Committee.” I had a vision for a founder-selected investment process where indie founders/bootstrappers chose which early stage entrepreneurs got funded based purely on our collective experience using the theory of the wisdom of crowds. According to Village Capital, peer selected investment is the most effective way for predicting which early stage founders will be successful. Anyway, they were the first 3 to tell me they were interested and here we are!

Alex: What are your investment criteria?

Jonathan: (1) Has the idea been pretotyped with skin in the game?

(2) Do you as a founder have potential to do something legendary in this space?

(3) Do we like how you logically think through the necessary problems/solutions?

Alex: What advice would you give to founders looking to pitch you? How should they reach out? What information should they include?

Jonathan: Learn and practice the art of pretotyping! I cannot stress this enough. It is the fastest and easiest way to prove that people will give up something for your hypothetical product/service. Ideally, I’d like every idea stage founder to come up to me and tell me:

-An XYZ hypothesis in the format of “At least X% of Y will Z” where X is the percentage of the target customer, Y is the target customer, and Z is the desired action.-A Hypozoom that focuses the XYZ hypothesis where a founder can test it now

-Choose a type of pretotype such as landing page, relabel product, video, manual MVP, etc.

-Measure skin in the game with validated email, phone number, or pre-order

-How many times you ran the experiment (3-5 is ideal) and what were the results

Alex: What companies have you funded so far?

Jonathan: We’ve funded ZIM Connections (eSIM app for travellers), GoCaptain (Buy Now Pay Later driving lessons), and Kinicho (spacial audio plugin for headphones).

Alex: What’s been the biggest challenge you’ve had to overcome?

Jonathan: Definitely finding out how to do the Future Earnings Agreement legally. After spending over £4000+ and months of going back and forth with lawyers in the beginning, I discovered Stepex while searching on Google, which was the first company to bring the FEA to the UK. We were so lucky that they agreed to help us service our FEAs and let us skip the FCA process (which they told us took 2 years and over £60,000). Also getting a bank account. You’d be surprised how few bank accounts allow people to do funds…

Alex: What’s a big problem you think needs to be solved but isn’t getting the right attention from founders and investors at the moment?

Jonathan: Funding education/narratives. I think despite only a tiny fraction of businesses being good fits for SAFE note investing, 95%+ of startups I’ve talked to in the UK want to raise an SEIS pre-seed round at some point. Idea stage founders in the UK need to be educated on all the different funding options that exist for them, from CFEAs to SAFE notes to revenue based financing to bank loans to grants. Holistic funding education for founders would be the first step in democratising entrepreneurship for all, and I think Considered Capital is doing a pretty decent job at that.

Alex: There seems to be a lot of disruption in venture capital at the moment, who are the disruptors and who are they disrupting?

Jonathan: In the US my favourite funds at the moment are probably Calm Fund and Chisos Capital, both using some form of hybrid loan-equity model to help bootstrapped founders at the earliest stages. In addition, I like seeing revenue based financing platforms like Pipe and Clearbanc (great for e-commerce businesses) as well as creative, new age loan platforms like Flowbo, Goodfin, and Fundbox. In the UK I haven’t seen as many VC disrupters from a pure finance-structure standpoint (which is why we chose to base our operations mainly here).

Alex: If you could have an introduction to anyone, who would it be?

Jonathan: Tyler Tringas

Alex: What are your goals for the next year?

Jonathan: Raise a £5-10 million Fund 1, spread further awareness on CFEAs so that the majority of aspiring/early stage founders in the UK know what it is, and give our portfolio companies enough support that they’ll smash all their goals in 2022 and more. Subsequently, serving our portfolio companies well will lead to great ROIs for us.

If you’re an investor looking for an innovative fund or a founder with an idea looking for capital, you can reach Jonathan at jon@horizan.vc or on Twitter here.

Thanks for reading, feel free to respond with any feedback and subscribe below.