This is the third part of my Angel Investing Toolkit, following on from Part 1: Education and Part 2: Deal Flow. This toolkit is designed for investors with previous investment experience in public companies and/or a couple of existing angel investments looking to learn more. Hobby investors (like me) will likely get the most value out of it, but I’m hoping some professional Angels will also use it. Please add any suggestions or questions in the comments or add me on twitter to suggest ideas for Part 4 - Adding Value. If you’re interested in hearing more from me on Angel Investing or operating startups - subscribe below.

⏪ Background

It has been almost a year since I wrote part 2 of the Angel Investing Toolkit: Deal Flow.

But you haven’t been idly sitting there scrolling through twitter with your cash in a bank account getting eaten alive by inflation… have you?

No. You have built a global network of angels, founders, VCs and syndicate leads.

You have joined so many investor communities you have muted your slack & WhatsApp notifications permanently.

You’re now riding a tsunami of Deal Flow and your inbox is busier than a work-gathering at 10 Downing Street. Your new challenge is assessing the startups flooding your inboxes.

I’ve put together a list of some of the best resources to help you assess startups, and I’ll also give you a look at what I do. But before we get to that, it’s important to ask yourself two questions.

First question: what is your goal with angel investing?

To some of you this may sound stupid, the answer is obvious right? Make money?

While this is the primary goal for many angel investors, it’s not the only goal. My other goals:

To learn - learn more about a particular technology, space or business in general.

To give back - there are certain areas I believe I have a good level of expertise and can help founders with.

To be part of something - being a (small) part of a startup’s journey is an amazing experience, and one worth paying for.

This part of the toolkit will be optimised for investors with a primary goal of maximising returns. However you should first consider if this is your goal, and if not create a framework to filter for that goal.

Second question: how much time do you want to invest in assessing startups?

‘Judgement is important but overrated.’

Naval Ravikant - investor & Co-Founder of AngelList

Some angels I know spend 99% of their time on getting access to the best deals, and less than 1% of their time on assessing them. This can be a very successful strategy.

There are three parts to angel investing: capital, access, and picking. Based on my experience, access is by far the most important part. If you have access, you can raise capital, and generally the most popular deals (i.e. the ones already discovered) also end up doing well. So picking becomes secondary.

Lenny Rachitsky - Angel Investor & Founder Lenny’s Newsletter

This strategy will likely provide the best results, on the assumption that you have an unlimited pool of capital. The vast majority of us do not, and so if you already have access to high quality Deal Flow, you will need a framework for making investment decisions.

As a general rule though: the earlier you are in your angel investing journey, the more time you should invest in ‘access’ over ‘judgement’.

Time spent assessing startups before you have access to great Deal Flow is time wasted.

👨🔬 My Assessment Method

A few caveats before you dig in:

All my investing is at Pre-Seed & Seed stage - my method and what I assess is not necessarily relevant to later stage investing.

I have been angel investing for 8 years and have enjoyed some success, but I do not consider myself an expert and am continuing to learn. My approach now is vastly different to what it was only 3 years ago.

I’m going to give you details of what I assess a company on, and in some cases how I assess those factors, but I’m not going to give full disclosure on the ‘how’ for every factor… otherwise some wily founders are going to use my post as a cheat-sheet.

👪 Team

‘The team is most important because it's the only thing that doesn't pivot in a startup. It's the startup that pivots around the team.’

Stephane Nasser

At the earliest stages the team is everything. The metrics are sparse. The product is limited and is likely to change over time. You need to find a way to assess the founders.

Here are the attributes I look for in Founders, in order of priority:

Sales Ability - This is critical to attracting investors, customers and talent to a company. A founding team without sales ability is dead in the water. This can be assessed in the deck, pitch meetings and also in how the Founders follow-up.

Work Ethic - You won’t build something extraordinary with ordinary hours. I don’t ascribe to ‘work smarter, not harder.’ You need to do both. If you’re not, you can bet a competitor emerges who will.

Generally I assess this by responsiveness of Founders to questions as part of the fundraising process. 1 hour response is top decile.

Resilience - Building companies is hard. It’s so hard that most founders who have a successful exit, never build another company. If you knew how hard it is before you started, you probably wouldn’t start.

The product and even the market may change significantly from when you invest. Founders who can deal with the ups and downs of that journey and will not give up when times get tough are the ones who will succeed. This is hard to assess through anything a Founder may say during a process. You have to dig deep into their work history and background to assess their resilience.

Intelligence - This isn’t important as work ethic for me. But a baseline level of intelligence is required in order for people to be good decision makers and navigate the journey ahead. I tend to assess this through asking a small number of questions on their market and historic decisions as part of due diligence.

This is also a good test for passion (and much better than simply the passion in their pitch) as detailed responses and market knowledge indicate a Founder who is passionate about their product and market.

Founding Team Dynamics - Founder break-up is one of the leading causes of startup failure. Founding teams who complement each other in skill sets, respect each other and communicate well are less likely to break-up. That can be assessed in how they interact (with an in-person pitch). It can also be assessed by understanding how long they have worked together in the past.

📱Product

At the very earliest stage the quality of the product can be a good indicator of some of the Founder attributes above.

However it’s generally very hard to assess the product accurately unless you are the target market for it.

Referral and retention metrics are generally the best indicators of product quality, so if any exist these are good ways to assess this.

🛒 Market Size & Competition

The size of the market in 5-10 years and what % of the market the company can capture are critical in understanding the potential revenue and valuation of the startup.

It is hard to predict this though. In general I have found market growth rate to be a better indicator than absolute current market size.

Competition analysis is important in some markets, but at the earliest stage I spend relatively little time on it. The only red flag for me is if a Founder does not mention a large direct competitor on their competition slide or as part of due diligence.

💰Finally…

There’s one thing which I have found in my current portfolio of investments which strongly correlates with success: shareholder updates.

The more frequent and higher quality the updates; the higher the chance of success of that company.

Therefore a new thing I ask if I’m not the first cheque is for a Founder to send me their last 3 shareholder updates.

But enough with my model… here’s 10 more from people with more expertise…

📝 10 Models for Assessing Startups

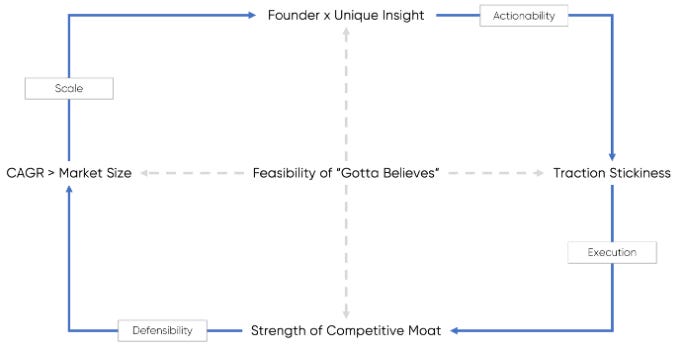

1. How to Assess and Early-Stage Startups by Stéphane Nasser

Stéphane has opened the book on how he assesses early stage startups. A deep-dive into three core areas of assessment: team, execution, strategy.

Do the founders bring an unfair advantage with them?

Sometimes, a founder brings an unfair advantage with him:

A blogger with a massive following in the target market

A scientist with strategic intellectual property in the field

A top executive with privileged access to C-level stakeholders

This is natural for teams that have a strong fit with the project and is a great signal overall.

2. A Template for Investment Memos for VCs by Ali Tamaseb

Ali has put together a template and structure for investment memos (the internal documents that VCs write to make decisions on whether to invest). It gives excellent insight into how to assess startups. I particularly like the competitive landscape mapping template.

3. How to Invest in Startups by Sam Altman

Sam covers many aspects of angel investing in this post, and it was one of the inspirations for me writing the Angel Investing Toolkit. Underneath the subtitle ‘Decisions’ you’ll see Sam’s framework on assessing startups.

Team is of paramount importance in Sam’s decisions.

Although good ideas are understandably seductive, for early-stage investing they are mostly valuable as a way to identify good founders. However, sometimes bad founders have good ideas too, and investing in them is the chronic investing mistake that has been hardest for me to correct. (My second biggest chronic mistake has been chasing investments primarily because other investors like them.)

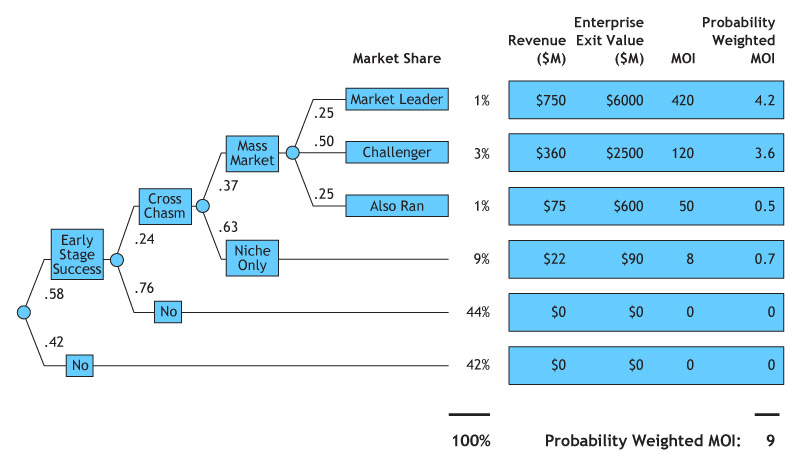

4. Applying Decision Analysis to Venture Investing by Clint Korver

Clint explains ‘decision analysis’, a framework for making decisions that marries the art and science of decision-making in a disciplined process.

5. Assessing: team, product, market, competition, business model by Patrick Ryan

This is a simple framework to get you started in terms of how you think about assessing startups.

Paddy has also open-sourced his scorecard template, which is a slightly deeper and more quantitative way of assessing companies, you can find it here.

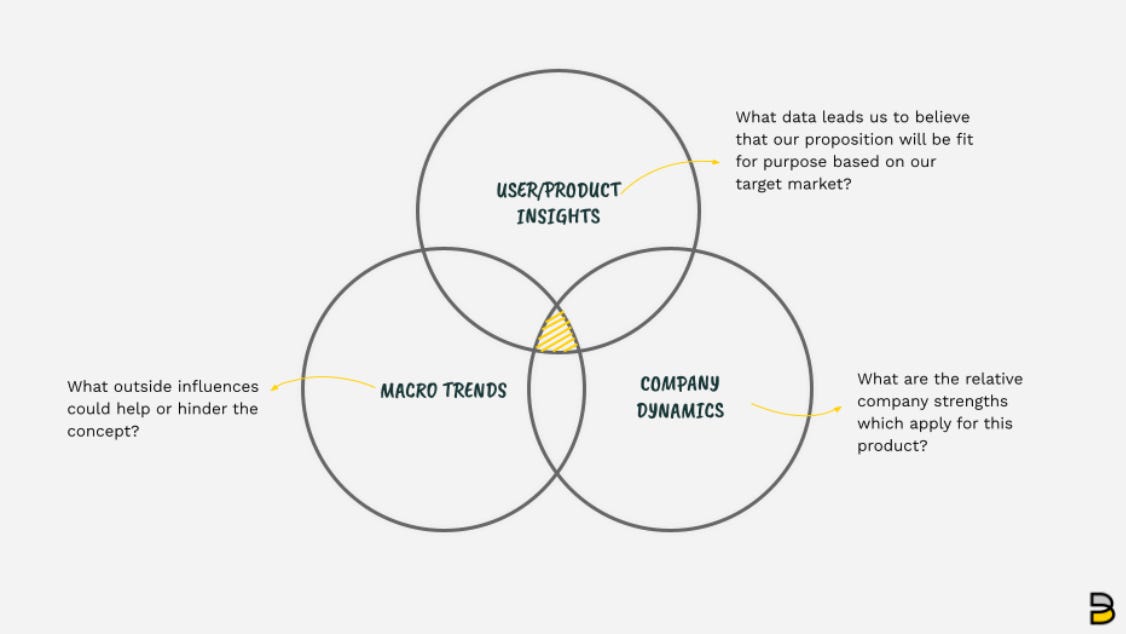

6. Score Product Ideas Like a VC by Craig Watson

Craig is an entrepreneur, but also spent time working as entrepreneur in residence at Frontline in London. Craig created a basic ‘algorithm’ to run product ideas through, with the goal of having a model with objective ratings for different dimensions while still leaving room to follow your gut instinct.

7. A Template for Calculating Statistical Expected Return-on-Investment of a Startup by Ali Tamaseb

This is another tool from Ali, following on from his VC memo above. Ali breaks the process down into 2 core parts: calculating probability across key success factors and calculating the potential exit. It’s another very mathematical approach to help you make investment decisions.

A 1% chance of becoming a $10Bn exit, is better than a 5% chance of becoming a $500m exit because the statistical expected exit of the former case is $100m and for the latter case is $25m

8. Evaluating early-stage startups: a framework for building conviction by J.P. Bowgen

J.P. is a VC and boils down assessing early-stage startups into three core areas: market, founder, product. It’s simpler than some of the other models in this list, and there is a beauty in simplicity.

9. A quantitative Approach to Product Market Fit by Tribe Capital

This is a fantastic essay on how to assess product market fit from one of the best-reputed funds of modern times. It is particularly useful when analysing Seed / Series A companies. This can be used by either Founders or Investors to assess product market fit.

10. How to Assess Startups Using Machine Learning by Arturo Moreno

I cannot imagine putting the burden of asking every startup founder I consider for investment for all the data points required to make this model useful. That being said, I think it’s interesting to see the data collected for this, and it could inform part of your own decision process on startup investing.

📚Further Reading

If you’re interested in reading more on how people assess startups, this list is a good place to start:

I’ve Invested in 2 Unicorns, Here’s My Advice on Identifying Strong Startups by Joe Gardner

Founders, here’s how top VCs are doing due diligence on you by Julius Bachmann

Evaluating Startups by Mike Troiano

Investing in Public: Non-Obvious Lessons from 100+ Angel Investments by Tod Sacerdoti

The 11 Lessons Dharmesh Shah Learned From 80+ Angel Investments by Dharmesh Shah

Lessons from 140+ Angel Investments by Lenny Rachitsky

Angel Investing by Paul Graham

33 Key Questions for Evaluating Early-Stage Startup Potential by Miruna Girtu

Finally some Twitter threads on assessing startups:

Thank you for reading. If you’re keen to learn more about angel investing or would like to join my syndicate, send me a DM on twitter.